Credit Report

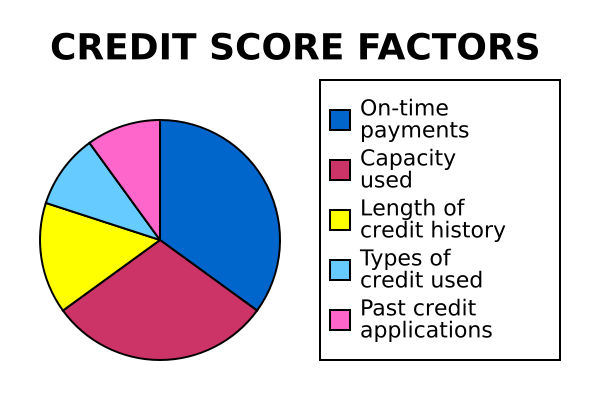

Information about you and your credit experiences, like your bill-paying history, the number and type of accounts you have, whether you pay your bills by the date they’re due, collection actions, outstanding debt, and the age of your accounts, is collected from your credit report. Using a statistical program, creditors compare this information to the loan repayment history of consumers with similar profiles. For example, a credit scoring system awards points for each factor that helps predict who is most likely to repay a debt. A total number of points — a credit score — helps predict how creditworthy you are — how likely it is that you will repay a loan and make the payments when they’re due.

Information about you and your credit experiences, like your bill-paying history, the number and type of accounts you have, whether you pay your bills by the date they’re due, collection actions, outstanding debt, and the age of your accounts, is collected from your credit report. Using a statistical program, creditors compare this information to the loan repayment history of consumers with similar profiles. For example, a credit scoring system awards points for each factor that helps predict who is most likely to repay a debt. A total number of points — a credit score — helps predict how creditworthy you are — how likely it is that you will repay a loan and make the payments when they’re due. So if you wonder how to repair your credit, the first thing you have to do is to get the latest copies of your credit reports. This is to find out what you have to repair as these reports have your latest credit information. Some insurance companies also use credit report information, along with other factors, to help predict your likelihood of filing an insurance claim and the amount of the claim.

So if you wonder how to repair your credit, the first thing you have to do is to get the latest copies of your credit reports. This is to find out what you have to repair as these reports have your latest credit information. Some insurance companies also use credit report information, along with other factors, to help predict your likelihood of filing an insurance claim and the amount of the claim.You can get a free credit report from each of the three credit bureaus every year and even order for extra copies by paying a fee. It is however necessary to get reports from all three credit bureaus as some creditors may report only to one credit bureau. With credit bureaus not sharing information, the different reports carry different information. Go through your credit reports.

On receiving the reports, you have to go through them and highlight all repairs. Any incorrect information like dues that aren’t yours and payments that were unnecessarily declared late should be disputed. Dispute all incorrect information in your credit reports by sending a letter and a copy of the highlighted reports to the credit bureaus.

On receiving the reports, you have to go through them and highlight all repairs. Any incorrect information like dues that aren’t yours and payments that were unnecessarily declared late should be disputed. Dispute all incorrect information in your credit reports by sending a letter and a copy of the highlighted reports to the credit bureaus. After clearing all the negative items on your credit report, the next, and perhaps last step on how to repair your credit is to get as much Michael Podgoetsky is an expert at positive information. The Fair Credit Reporting Act (FCRA) also gives you the right to get your credit score from the national consumer reporting companies.

After clearing all the negative items on your credit report, the next, and perhaps last step on how to repair your credit is to get as much Michael Podgoetsky is an expert at positive information. The Fair Credit Reporting Act (FCRA) also gives you the right to get your credit score from the national consumer reporting companies.If your credit report indicates that you have paid bills late, had an account referred to collections, or declared bankruptcy, it is likely to affect your score negatively. Many scoring systems consider whether you have applied for credit recently by looking at “inquiries” on your credit report. Scoring models may be based on more than the information in your credit report. Sometimes you can be denied credit or insurance — or initially be charged a higher premium — because of information in your credit report.

Because credit scores are based on credit report information, a score often changes when the information in the credit report changes. If you are denied credit or not offered the best rate available because of inaccuracies in your credit report, be sure to dispute the inaccurate information with the consumer reporting company.

To order your free annual report from one or all the national consumer reporting companies, and to purchase your credit score, call toll-free 877-322-8228, or complete the Annual Credit Report Request Form and mail it to: Annual Credit Report Request Service, P. O. Box 105281, Atlanta, GA 30348-5281

To order your free annual report from one or all the national consumer reporting companies, and to purchase your credit score, call toll-free 877-322-8228, or complete the Annual Credit Report Request Form and mail it to: Annual Credit Report Request Service, P. O. Box 105281, Atlanta, GA 30348-5281

Casino Roulette Rules and Basics

Roulette is one of the most popular gambling games in history. It originated in 18th-century France and has been popular ever since. It spread through Europe and America. It's a very easy and thrilling game which makes it a favorite among gamblers, whether it's a real casino or online. There are two kinds of this game, European and American. They are slightly different to each other, but the rules are basically the same. Europeans use a single zero wheel, and Americans use the double zero wheel. Roulette is entirely a game of chance. Although there are strategies that exist to predict the outcome of the game, but in the end, it is mostly out of luck.

Roulette is one of the most popular gambling games in history. It originated in 18th-century France and has been popular ever since. It spread through Europe and America. It's a very easy and thrilling game which makes it a favorite among gamblers, whether it's a real casino or online. There are two kinds of this game, European and American. They are slightly different to each other, but the rules are basically the same. Europeans use a single zero wheel, and Americans use the double zero wheel. Roulette is entirely a game of chance. Although there are strategies that exist to predict the outcome of the game, but in the end, it is mostly out of luck.About Roulette

Roulette is a staple game in casinos. Six to eight players can accommodate a table. The game does not need any card skill like poker, although risks are quite the same. A player can go from

rags to riches in a blink of an eye, but it can also end up the other way around.

The game means small wheel in French which is the main focus of the game. It's a wheel with a tilted circular track and colored numbered pockets outline its circumference. When the game

begins, the dealer spins the wheel on direction and the ball at another. The main objective of the game is to bet on the right number where the ball will land in at the end of the spin. Adjacent to the wheel is a layout of the numbers on the wheel where players can place their bets. Players can set their bets until the dealer signals "no more bets" and spins the wheel.

The player can bet on a number, group of numbers, color of the wheel, and odd or even. Bets are classified into inside or outside bets. Inside bets involve numbers while outside bets consist of groups of numbers, red or black, odd or even numbers.

Inside bets

1. Straight up - Bet on a single number. Chips are placed squarely on a number.

2. Split - A bet on two numbers next to each other. Chips are placed on the line between them horizontally or vertically.

3. Street - Bet on three number on a single line. Chips are placed at the edge of last number on the line.

4. Corner - Bet on four numbers within in square layout. The chips are placed on the intersection between the four numbers.

5. Six line - Bet on two streets next to each other. Chips are placed in the intersection.

6. Trio - Bet on 0, 1, 2 or 0, 2, 3. The chips are placed at their intersecting points.

Outside Bets

1. 1 to 18 - Bet on a number on the first low eighteen.

2. 19 to 36 - Bet on a number in the last high eighteen.

3. Red or Black - Bet on a color on the wheel.

4. Odd or even - Bet on an even or odd number.

5. Dozen bets - Bet on either the first, second or third setoff

twelve numbers.

6. Column bets - A bet on twelve numbers at any of the vertical

lines.

About The Author: Discover the best tips for roulette including

an amazing roulette strategy with a 99.4% win rate. For free

info visit: http://www.easycasinoprofits.com

New agency to protect consumer rights ( Mortgage )

Tess Vigeland: Harvard Professor Elizabeth Warren has been in the headlines recently, because she's the watchdog over the TARP money being doled out to the nation's banks.

But we're talking to her because of her previous activism on another issue that came to the fore this week. Two years ago, she wrote an article proposing the idea of a financial product safety commission. She argued that we consumers needed the same protection for our finances that we get for the toys and appliances that we buy. Well this week, the Obama administration proposed just such an agency.

Elizabeth Warren, welcome to Marketplace Money. And how about we talk about something other than TARP?

Elizabeth Warren: Oh, I'd like that.

Vigeland: So when you first proposed this idea two years ago, what were you seeing in the marketplace that prompted your concern. Was it a specific financial product?

Warren: No, it's that the marketplace is broken. Put four credit card contracts down on a table and try to make a comparison. Try to figure out which one's cheaper, try to figure out which one's safer. It's not possible. The average contract is more than 30 pages long and let's face it, most of the terms are written in a form of legalese that even a Harvard law professor would have a lot of trouble with.

And what that means is that we switched over to a different kind of pricing model for credit cards. The company holds up two or three things to show you -- like the nominal interest rate, the free gifts and the warm and fuzzy relationship. And then they build all the so-called "revenue enhancers" into that 30 pages of unreadable text. So if you can't tell whether card A, card B, card C or card D is the cheaper card or the better card, the market isn't working.

Vigeland: Well, explain what we're talking about when we compare the Consumer Product Safety Commission with something that would be similar for really non-tangible products. One is about protecting us from, I don't know, exploding gas car tanks and lead toys. This one would protect us from what beyond credit cards?

Warren: The idea behind both of them is it protects us from the things we can't see. The notion is markets don't work when certain elements of the competition or certain elements among the products are not visible. So what happened in the case of the Consumer Product Safety Commission, basically, is they said, "Look, here are the minimum safety standards. So if you want to compete, find other ways. Don't compete by taking out the insulation and making your manufacturing cheaper."

It's really the same thing with credit cards. All we're saying here is don't compete by hiding a bunch of terms in 30 pages of incomprehensible text. Put the product right up front, anyone can see it, and make a good decision.

Vigeland: What do you see as the tipping point from the need for regulation to the need for personal responsibility? I mean, at some point, shouldn't we all recognize that credit cards are not inherently safe for us?

Warren: You bet. The financial protection agency is not about protecting consumers from themselves. You can go out to the mall and spend $2,000 on things you can't afford, by golly, you ought to be responsible for it.

What this is about is the heart of the personal responsibility. It's hard to have personal responsibility if someone is trying to trick you or deceive you about what the terms of the agreement are. My view on this is let's put that all out front, let's have plain vanilla products and then they should be responsible for honoring those contracts.

Vigeland: You know, this isn't all about incomprehensible contracts and language. Isn't this agency supposed to be able to stop some financial products from even getting out on the market?

Warren: It's about dangerous products and about what consumers can understand. Let me give you the best example I can, that is I was in a hearing before Congress and one of the senators asked one of the bank executives sitting next to me to explain double-cycle billing.

Vigeland: Good luck with that

Warren: The bank executive mumbled and fumbled and started and tried again and finally said, "I can't." Well my view is, if you can't explain it, then you can't sell it.

Vigeland: Again, I think the question is: Will this agency potentially be able to stop such destructive practices, as -- not just credit cards -- but the option arm. Will that still be available to people, even though it's so hard to understand?

Warren: There may be a place for complicated financial products. For people in certain circumstances, it may be appropriate. But it's appropriate only if there has been enormously careful disclosure and qualification of that customer for that kind of product. This is not about limiting consumer choices; this is about making sure that those choices are real. For most of us, that means plain vanilla products.

Vigeland: But would an agency like this be able to prevent, say mortgage brokers, from offering a mortgage like that?

Warren: The key thing is it would prevent mortgage brokers from deceiving people about these mortgages. That's been a large part of the problem we've got right now. People have been steered into products that are entirely inappropriate for them and that were never fully explained. That's the practice that will be stopped.

Vigeland: Elizabeth Warren, thank you so much for talking with us.

Warren: Thank you.

RIMM Earnings Miss

This past Sunday I asked the question, Is RIMM Tech’s Last Breadth? It seems the answer may be “yes”.

NASDAQ futures have dropped heading into the market open tomorrow (Thursday) as the BlackBerry maker tanked after disappointing earnings.

Research in Motion (RIMM) reported after the market close and immediately free fell even after doubling its revenue to $2.24 billion from $1.08 billion last year. The reason for the slide was a disappointing forecast that left investors questioning the tech giant’s future.

Below you can see a screenshot of RIMM stock today and the impact the earnings had in after hours trading:

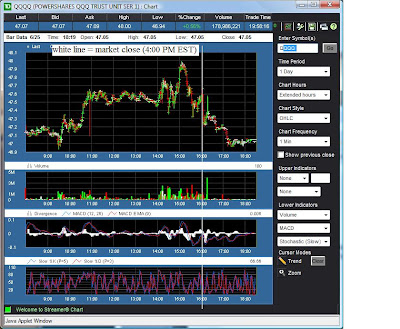

This in turn has caused the market futures to tumble as fears of a recession continue to overtake investors minds. Below is a screenshot of the QQQQ which tracks the NASDAQ 100 market index. Notice the slide after the bell:

The reason I posted last Sunday on RIMM stock was because RIMM was one of the few remaining tech stocks still trading near highs. Investors were holding onto the belief that a big earnings report could trigger a broader rally, proving that maybe the economy wasn’t so bad after all. Now with RIMM set to gap down at the opening bell tomorrow and no tech stocks left to lead the only index, “holding it together” the future seems bleak.

Stanley® FatMax® Xtreme™ FuBar™ Utility Bar

Design Credit:

Stanley Mabo S.A. (France) and The Stanley Works

Client:

The Stanley Works

With FuBar say goodbye to rooting around for the right tool or forcing a tool to perform as it’s not intended. FuBar combines the four most-needed tools—hammer, crow bar, board bender and splitter—into one solid, properly weighted, ergonomically correct tool. And at four pounds, it is still quite portable and able to fit into a tool belt. FuBar looks as intimidating as the tough demolition jobs it tackles, and its rugged design cues match the ferocity of the work, especially the large open jaws that look like they can attack anything in their path. FuBar received Popular Science’s Best of What's New Award, and demand from retailers is outpacing supply. Unexpectedly, FuBar has also become popular with fire and rescue professionals as an effective life-saving tool.

Source http://images.businessweek.com/ss/07/07/0720_IDEA/source/35.htm